注目

- リンクを取得

- ×

- メール

- 他のアプリ

About the definition of capital

“Capital” in Marxian economics

theory

Since Marxian

economics aims to characterize a capitalist society, it is essential to define

what capital is. The principle of Marxian economics usually defines capital as “self-expanding

value” or “self-valorizing value.”

On the other hand, in neoclassical economics (microeconomics), capital is usually described as “the combined value of business’s assets; includes equipment, buildings, tools, inventory, and financial assets”(Krugman and Wells, Microeconomics). However, this definition means that capitalist society has long existed since human society had some means of production. Rather, even if neoclassical economics has an explanation about capital, it essentially has no explanation for capitalism.

“Capital” has two meanings: and property and subject of activity

When using the

term “capital” in the lecture on the principle of Marxian economics, I

sometimes get a question of whether capital means “property” or “the subject of

activity.” From a materialistic standpoint, when a property is placed in a particular

state, it becomes capital. Then, the capital is personalized, and the personalized

capital manages the capital as property. Therefore, we use the term “capital,”

which has both meanings of “property” and “the subject of activity.” However,

it may be challenging for students who are not accustomed to the materialist

way of thinking.

Then, should we

describe the subject of the activity as a “capitalist”? That is not the case. The

term “capitalist” conveys an image of an individual capitalist. Instead, it is

difficult to assume a capitalist as the subject of decision-making in joint-stock

companies. Shareholders only indirectly influence the decision-making of

capital activities. Although management appointed by shareholders make daily

decisions, they do not own equity of capital sufficiently. Because the term “capitalist”

usually recalls a possessor of capital as property, it is inappropriate to call

management. The management is capitalist as long as they act subordinated to

the will of capital.

In the past, Kozo Uno claimed that individual capitalist is the original type of capital and that a joint-stock company cannot be explained in the principle of political economy. However, theorists of modern Uno theory maintain that individual capitalists and combined capital (stock capital) are equivalent and that capital is expressed in each form (Obata [2009] pp.304-305).

小幡『経済原論:基礎と演習』(Obata, Michiaki [2009] The Principles of Political Economy: basics and exercises, Tokyo: Tokyo Daigaku Shuppankai.)

Definition of capital by Sakura[2019]

The main subject

is from here. “Self in self-expanding value means valorization by the capital’s

own exercise. In other words, capital needs metamorphosis: commodity → money → commodity → money →…. Even if the value increases without metamorphosis,

it is not capital. For example, workers are not capital by saving wages, or landowners

are not capital by saving rent. They only sell repeatedly their commodities: the

right to use labor or land for a definite period.

Now, Sakura

[2019], a recent textbook based on modern Uno theories, defines capital as a “contribution

for valorization” (p. 50). Here, commodities and money as forms of value must be distinguished from

the capital itself. This definition is not unique but based on the definition

of capital investment by Obata [2009]. Obata [2009] defines capital investment

as “separating and confirming the foundation for valorization from all the

assets.” These are similar to the definition in accounting. An accounting

textbook defines it as “the money invested in, or the productive capacity,

provided by the residual equity holders. It is the difference between the sums

of total assets and total liabilities (Jayne Godfrey, Allan Hodgson, Scott

Holmes. Accounting theory).

さくら原論研究会『これからの経済原論』(Sakura Genron Kenkyukai (Ed.) [2019] Redesigning the Principles of Political Economy, Pal Shuppan )

Importantly, “capital” is not a thing as asset but the foundation for such assets to exist.

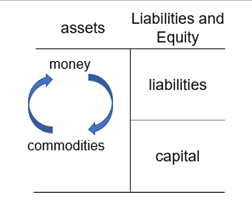

Let us explain using the balance sheet. The balance sheet shows assets and capital as follows (Sakura[2019]p.52, 57).

This figure is formed from the first capital investment as follows.

Then, Sakura[2019] distinguishes between

commodities and money as forms of value and the capital itself. According to Sakura[2019],

his distinction enables us to understand banking capital (pp.57-58).

The balance sheet of banking capital is as

follows.

Capital and

assets are different. Banking capital does not have the equalized rate of gross

profit like industrial capital, but only variable rates of net profit.

However, even if

we recognize the advantages of this method, some questions remain. The basis

for equalizing the gross profit rates is the determinism in the production

process, which has the assets on the left side of the balance sheet. If the

leverage on the right side can be changed, the equalization of the gross profit

rates cannot be explained.

In addition, if we

maintain the distinction between capital and assets, productive capital/circulation

capital or fixed capital/circulating capital must also be rewritten as productive

assets/circulation assets or fixed assets / circulating assets, respectively. Indeed,

accounting maintains these distinctions. However, Sakura[2019] keeps using the

term “capital” (p.132, 155).

The word “capital”

has some ambiguity when viewed from many different viewpoints. The concept of

capital has yet to be studied, and theorists of modern Uno Theory have been

discussing it in various ways.

コメント

コメントを投稿