注目

- リンクを取得

- ×

- メール

- 他のアプリ

Monetary Circuit Theory (MCT) in balance sheet

0. Introduction

Monetary Circuit Theory (MCT) explains the nature of credit money by connecting the creation of credit money by banks and the production by firms. It sees money as a motion of being created, circulated and destroyed. The creation of money by banks is the starting point for generating new income. Since no new wealth is created by simply exchanging existing wealth (as in barter), money must have no intrinsic value by itself and must be created from nothing (ex nihilo). There are some similarities with Marxian economics, which sees capitalist production as M(money) – C(commodities) –M’(increased money).

1. Basic simple pattern

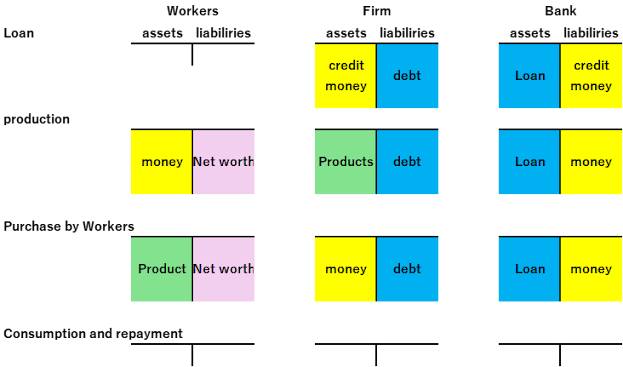

First, banks lend money to firms by creating credit money from nothing (ex nihilo). Firms use this money to pay workers and begin production. This is called initial finance.

Then, firms sell products to workers, receive the money back, and repay their loans to the banks. This is called final finance.

Basic pattern

2. Final finance with voluntary saving

If some products are not sold, money stays in the hands of workers. If firms issue securities and can sell them to workers, they can receive money back and repay it to the banks. The unsold products then remain as savings (inventory investment).

Monetary circuit with voluntary saving

3. Final finance with involuntary forced savings

However, if there is no voluntary saving, firms may raise prices to get back the full amount of borrowed money. Workers cannot buy all the products with the same nominal income. Firms then recover enough money to repay their loans, but some products remain in the hands of firms. These products are counted as savings in national accounts (capital formation).

Monetary circuit with involuntary saving

This figure shows that by raising prices, firms retain some products as an increase in net worth, which is profit—even though it takes the monetary form.

4. “paradox of profits”

Products kept in firms at he end of the tperiod means an increase in net worth — that is, profit for firms.

There is a well-known question called the “paradox of profits”: where does the money come from to buy the products?

This “paradox” appears because MCT focuses too much on the money form of wealth. Similarly, some Marxist thinkers, like R. Luxemburg, focus too much on the money circuit (M – C – M′) and face the same problem.

We must distinguish profits themselves from monetary profits.

5. Interpretation from Marxist economics

Certainly, capital must increase its value. However, the increase does not always have to appear more money, as the circuit, M – C –M’, suggests. In fact, the profit of capital is the increase in the total value of money and commodities, which accrues through the cyclical movement.

Also, MCT incorrectly assumes that firms make profits by raising prices and keeping some products in their hands (e.g., Graziani, 1990, The Theory of the Monetary Circuit). However, from the orthodox Marxian view, it is not necessary to assume monopolistic market operation, because industrial capital exploits more value than it pays in wages.

コメント

コメントを投稿